Mutual Fund Investments Secrets Revealed.

Mutual Funds were created to make investing easy. So consumers wouldn’t have to be burdened with picking up individual stocks.

Scoot Cook

Due to a lack of knowledge, most of the investors are still investing money in bank fixed deposits or Post Office Schemes or Government Bonds.

Despite the lower interest, they are investing in fixed deposits or recurring deposits only because of security.

You need to study various Mutual Funds if you want to get better returns on your investments.

If you are planning to invest for the long term through SIP there is a chance of high profit on your investments.

You can have an option to switch over to another scheme if your selected mutual fund performs poorly.

Since your money is invested in various industries if one of them does not perform well the other performing industries make up your losses.

Depending on your investment objective you can choose/ select Mutual Fund plans after studying the past performance of the Mutual Fund.

For long term investment in Mutual Funds, investors can get better returns in the range of 15% to 18%. Always higher than any Fixed Deposit or Other Government Tax saving instruments or Bonds.

It is possible to become rich with investment in Mutual Funds because of compound interest, your value of investment likely grows in value over time.

If you are planning to invest for the long term through SIP there is a chance of high profit on your investments.

You can have an option to switch over to another scheme if your selected mutual fund performs poorly.

What are Mutual Funds?

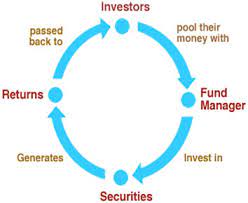

There are numerous Mutual Fund Companies. These companies invest money on behalf of their investors in Stocks, Bonds and other assets.

The Mutual Fund company brings money together from investors and invests it in stocks, bonds and other assets. The combination of this is called the Portfolio of the Mutual Fund.

Every Mutual Fund is managed by Fund Managers who are responsible for implementing a fund’s investment strategy.

Mutual Funds are operated by professional money managers, who decide where to allocate the fund’s assets and produce capital gain on income for the fund’s investors.

A Mutual Fund’s portfolio is organised and balanced to match the investment objective mentioned in its prospectus.

Most of the investors think that investment in Mutual Fund is Gamble.

You need to invest a large sum of money in Mutual Funds.

You need to have complete knowledge of Mutual Funds to invest.

Truly speaking whenever you want to invest money your motive is to earn money or get something above the investment.

Depending on your objective of Return on Investment, you decide where to invest.

Some investors think that they should just invest the money in a Mutual Fund and forget. However, you need to review your portfolio regularly.

There is another misbelief, that once you invest in a Mutual Fund you will get guaranteed income on investment.

More your expectation, more the risk, is a rule of investment.

So wherever you invest; you are investing in calculative risk.

The same is applicable with Mutual Funds.

There are various options available in Mutual Funds. It’s your choice, to get the best among available.

There are a lot of misconceptions about Mutual Funds in India. Hence most investors do not invest in Mutual Funds.

Why Mutual Funds?

Everyone in life invests money for a better future. There are two types of investments, short term investments and long term investments.

There are various types of investment vehicles, like Fixed Deposit, Investment in Gold, Stock Market, Life Insurance, Shares etc.

Every investment has its own advantages and disadvantages. Depending on the investment objective we choose, which type of investment is suitable for achieving financial goals.

One of the investment vehicles is Mutual Fund. So why do we need to invest in Mutual Funds?

Let’s check.

There are certain benefits to investing in Mutual Funds.

Mutual Funds are managed by a professional Money Manager. Who invests in two main sections equity and debt, or some only in equity and some invest in debt and others are hybrid and balanced.

Hence your amount invested in the fund is a Diversified Portfolio. With a small amount of investment, you can get exposure to a variety of shares.

If a few shares in the fund don’t perform, the others will compensate for the loss.

You need not do research in stock, just invest in Mutual Fund as per investment objective.

The best part of Mutual Funds is, you can invest a small amount of Rs.500/-

Either you invest in Lumpsum or SIP ( Systematic Investment Plan). If you have idle cash you can go for a one-time Lump Sum.

SIP is also a good option for small investors for long term investment.

There are more than 2000 options available for selecting funds as per your investment objective.

Debt funds are less risky, balanced or hybrid are moderately risky and equity funds involve high risk.

You also have the option of Small Cap, Mid Cap and Large Cap funds.

On Debts funds, the return on investment is lesser than the Equity Funds. So higher risk, higher return.

The investment in Mutual Funds are having high liquidity, In an open-ended scheme, you can buy and sell units anytime. The value of units is based on the Net Asset Value (NAV) of that fund.

So Mutual Funds are having high liquidity. However, some tax saving funds have a lock-in period of 3 years.

There is also a benefit of Tax Exemptions on certain funds.

In share market investment you can not have the benefit of diversification, as we cannot buy shares of a variety of industries. If you want to invest Rs.1000/-, you will end up buying one or two companies. The same is not with Mutual Funds.

Considering the available option for investment Mutual Funds is going to be the best option than the other investment vehicles.

Conclusion.

Mutual Funds can hold different types of securities, which make them attractive compared to other investment options.

Diversification minimises risks in Mutual Fund Investments, and a long term investment plan through SIP gives decent returns on investments.

Even if you are having a small amount to invest you can invest in Mutual Funds.

Considering the return on investments Mutual Funds are the best option to invest in than the share market.

The risk involved in Mutual Funds is comparatively less than the stocks. All other investment options like fixed deposits, government bonds, post office schemes are having guaranteed returns.

Comparing these options with Mutual Funds, Mutual Funds give a better return on investment with calculative risk.

Considering your objective and term of investment, select your Mutual Fund based on past performance and you are at low risk.

Study various Mutual Funds, If you want to earn on your Investments in Mutual Funds.

Whenever you think about the investment of your money it is always better to have an expert to guide you.

A good investment adviser can help you to maximise your return on investments.

From the expert point of view, Mutual Funds are the best option for investment to achieve your goals.

So why are you waiting?

Let me know your opinion in the comment box.